Can You Now Convert an ADU into a Condo? AB 1033 ADU Explained

Introduction

Since their inception, existing law in California has prevented accessory dwelling units from being sold separately for a primary dwelling unit. While ADU’s can make a ton of financial sense as rental units that are accessories to a primary residence, there is significant benefit for investors and entry level home buyers if ADUs are allowed to be sold separately. State lawmakers recognized these benefits and CA AB 1033 ADU was born.

What is Assembly Bill 1033 ADU?

AB 1033 California is a bill that would allow the sale and condo-ization of accessory dwelling units built on residential property. The bill would allow individual cities and counties to pass laws to allow accessory dwelling units to be sold separately from a primary residence.

What is Condo-ization?

When you think of condos you may think of larger residential buildings that were built with the purpose of being sold off as individual condo units. In reality, condo’s are less of a specific type of construction and more of a form of co-ownership.

Condo-ization is not a new concept. Looking back at previous real estate cycles we have seen many types of properties converted into condos. Here in Long Beach we have seen periods of time where apartment buildings that were built to rent have been converted into condos. Condo-ization involves taking a single property and allocating ownership of separate units to different owners. This allows two or more distinct parties to legally own discrete parts of the same property without having to subdivide the land.

Condo-izing an ADU mean that one party owns the primary residence and another party owns the ADU and the two parties have co-ownership of the land and common areas which would be managed by an HOA. In this scenario the ADU is considered separate property from the primary residence and can be sold and financanced separately.

While almost every property could be condo-ized, often state and local regulations prevent this from happening. AB 1033 would eliminate restrictions at the state level and give power to local governments to allow ADU properties to be condo-ized.

What are the potential benefits of Condo-ization?

It’s no secret that housing prices in CA are some of the highest in the nation and it can be incredibly hard for first time home buyers to enter the market. ADUs are one of the most cost-efficient ways for mom and pop developers to add new units to the market and gently increase the density of residential neighborhoods. Over the last several years ADUs have been built to rent, which helps to alleviate the shortage of rental units in CA. AB 1033 could open up a reservoir of reasonably priced housing for entry level home buyers. According to an article from Business Insider, over 63,000 ADUs were built in California between 2018-2021.

AB 1033 would also have major benefits for current homeowners who could use the proceeds from the sale of the ADU to cover the cost of construction and leave them with nice profits without having to become landlords. A condo-ized ADU could also have potential to be financed separately from the primary residence.

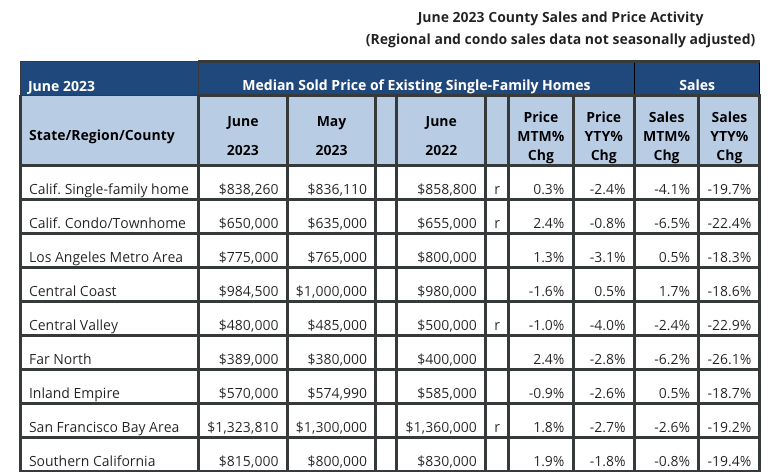

According to data from the California Association of Realtors, the median price for a single family home in the LA Metro Area in June 2023 was $775,000 and the California median price for a condo or townhome came in at $650,000.

ADU Condo-ization Outside of California

Not only is AB 1033 realistic, but similar laws are already working in other parts of the US. Some notable markets where ADU condo-ization is taking place include Seattle, WA, Austin, TX, Portland, OR, and Princeton, NJ! Thatch Nugyen, a real estate developer and youtuber has been posting content about the benefits in Seattle Washington and has told investors in other states that condo-ization is the next logical step in markets where ADUs are already allowed. In a recent video, he highlights an ADU condo-ization project that one of his students completed and Thatch tells investors to get ready for laws like AB1033 to take effect and open up huge opportunities for mom and pop investors.

AB 1033 Bill Progress

As of September 11, 2023 the bill has passed in both the CA Senate and CA Assembly. The bill will be proofread and sent to the Governor for the final decision. Track the bill progress here.

Unlock New Investment Opportunities: ADU Sold Separately in California

Leave a Reply