What is a VA Loan?

VA loans are a unique type of real estate loan that are offered to US Veterans, Service Members, and non-remarried spouses. The VA loan was created at the tail end of WWII and signed into law by Franklin D Roosevelt. The program offers Veterans a way to purchase a primary residence with 0% down. This is an incredible benefit that comes along with being in the US armed forces. The VA loan is one of the best residential loan products available with as little as 0% down, no mortgage insurance, and some of the lowest interest rates available. VA loans can be utilized on residential properties between 1-4 units. Many Veterans use the loan program as a way to jump start their multifamily investment portfolio.

Benefits of VA financing

No Down Payment

One of the biggest VA home loan benefits is that there’s no down payment. As long as you qualify for the loan based on your credit score and debt ratios you can purchase up to a 4-unit property with no money down!

No PMI

VA loans also require no Private Mortgage Insurance (PMI), as many other loan programs do. Though VA loans do come with an upfront funding fee, the cost of this pales in comparison to mortgage insurance, which can cost you both at closing and monthly for the life of your loan. Investors who don’t have access to VA financing will need to pay monthly mortgage insurance on all qualified mortgages that allow less than 20% down. The absence of PMI saves VA buyers thousands of dollars per year! More info on VA funding fees can be found here.

Lower Interest Rates

The Department of Veterans Affairs guarantees VA loans, which means it will repay lenders for a portion of their losses should a borrower fail to make payments. This reduces the risk allows lenders to offer more competitive rates to VA buyers. In fact, VA loans have the lowest average interest rate of all residential loans.

VA Loan Program Requirements

Owner Occupancy Requirement

While you can purchase up to a 4-unit building with the VA loan program it’s important to remember that the loan was originally intended to help service members purchase a primary residence. If someone uses a VA loan to purchase a multifamily property they must still meet the owner occupancy requirement by living in one of the units. Borrowers are required to move into one of the units at the property within 60 days of the loan funding. If a VA borrower were to purchase a 4-unit building they could live in one of the units and still collect rental income on the remaining 3 units.

VA Loan Qualification

The first step in qualifying for a VA loan is to make sure that you meet the service requirement. If a person has served for at least 90 continuous days (all at once, without any breaks in service), they should meet the active-duty service requirement.

Assuming the VA service requirements have been met, lenders will gather documentation of employment history, credit report, current income and financial assets, and current monthly debt so they can pre approve borrowers for a loan.

Be sure to let your lender know if you plan to purchase a multifamily property. Lenders can use a portion of rental income from the units that you don’t intend to occupy to help you qualify for a larger loan. For example, if you purchase a 4-unit building one of the units must be intended for your primary residence and the other 3 units can be used as investment property. If the 3 units that are being used as investment property each rent for $2000 per month, a lender can count 75% of the total annual rental income towards the income you use to qualify for the loan. In this case, the property would generate $6,000/month of rental income or $72,000/ year in rental income. ($72,000 x 75%= $54,000) This means the lender can use $54,000 of rental income to help you qualify for a larger mortgage. Not bad!

Property Condition Requirements

One of the conditions of the VA loan program is that the property must be safe, structurally sound, and sanitary. This condition requirement is intended to protect the interest of veterans, lenders, loan servicers, and the VA. During the escrow process the appraiser will point out any property condition issues that do not meet the VA loan guidelines. Some of the most common issues that come up during a VA purchase are health and safety issues like missing smoke detectors, broken windows, and improper water heater strapping. Issues are typically required to be corrected before the loan can fund.

The VA loan also requires that a borrower get section 1 termite clearance prior to the close of escrow. In competitive markets asking a seller to complete repairs during escrow can sometimes make an offer less competitive. It’s important to work with a real estate broker who has experience with these types of negotiations so that you get your VA offer accepted.

No Self Sufficiency Requirement

It’s also important to point out that VA loans DO NOT have a self sufficiency requirement. Another low down payment loan program called FHA requires 3 & 4 unit properties to pass something called the self sufficiency test. This test makes it extremely difficult for FHA buyers to purchase 3 & 4 unit properties. You can read more about the test here. The absence of a self sufficiency requirement is another amazing VA loan benefit that makes it an attractive loan program for multi unit investment property.

Can You Use A VA Loan More Than Once?

The short answer is: yes!

A VA loan can be used multiple times by the same borrower. However, in order to use a VA loan multiple times it’s important for borrowers understand VA loan limits, VA entitlements, and VA loan restoration.

VA Loan Limits

As of January 2020 there are no loan limits for VA. If you are purchasing a property with a VA loan and you have your full entitlement then the VA will guarantee 25% of the purchase price. VA entitlements only come into play when a borrower wants to have more than 1 VA loan at the same time.

It’s important to note that while there are no VA loan limits, VA borrowers must still qualify for the loan based on their debt ratios, credit score, etc. VA lenders may also have different interest rate pricing based on the loan amount and qualifications of the borrower.

VA Loan Entitlement

The government provides a financial guarantee on every VA loan and this guarantee is like a form of insurance for the lender. The VA promises to repay a portion of the loan to the lender if a borrower defaults. The VA typically insures a quarter(25%) of the loan amount and that guarantee is reflected in a dollar amount called an entitlement. There are 2 layers of entitlement. There is basic and bonus or secondary level.The basic entitlement is $36K, which is what will be shown on the “certificate of eligibility”. The bonus entitlement is calculated based on the conforming loan limits in your area. You can look up your county loan limit on the Federal Housing Finance Agency’s Website.

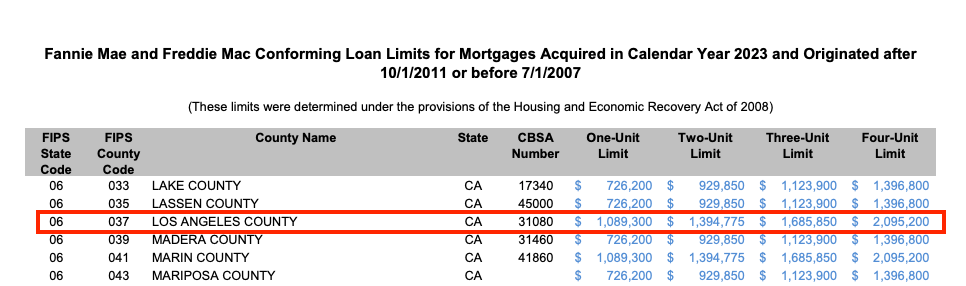

For 2023 the VA mortgage loan limits in LA county are as follows:

Calculating VA Bonus Entitlement

To get your basic entitlement, take $36,000 and multiple by four. That’s the initial amount you could borrow using a VA loan. ($36,000 x 4= $144,000)

To get your bonus entitlement, take the conforming loan limits for your county (let’s say $1,089,300 in this case) and divide by four: $1,089,300 / 4 = $272,325. Then subtract your basic entitlement: $272,325 – $36,000 = $236,325. In this scenario, your bonus entitlement would be $236,325.

In this scenario, if a borrower were to purchase a home for $750,000 in they would use $187,000 of their entitlement and they would have $48,825 left over which they could use to purchase another property with a VA loan without having to refinance out of the first VA loan. This remaining bonus entitlement would allow someone to purchase a property that costs up to $195,300 with no money down ($48,825 x 4 = $195,300). If the purchase price was over $195,300K the borrower would need to put down 25% of the difference. For example if the second property cost $700k then the borrower would need to come in with $126,175 as a down payment. ($700,000 – $195,300= $504,700, $504,700 x 25% = $126,175).

In high cost markets like southern CA it is rare to have enough entitlement to purchase 2 properties with 0% down. If a borrower wants to reuse their VA mortgage they can also look at restoring their entitlement.

Restoring a VA Entitlement

Let’s say you buy a 4-unit property with a VA mortgage, use one unit as your primary residence for a year, and then want to purchase another property but you don’t have enough entitlement for the 2nd property. One strategy to make this work would be to refinance the 4-unit property from a VA mortgage into a conventional mortgage. By doing this you pay back the VA mortgage and restore your entire entitlement to be reused again. The VA only allows this VA restoration to occur one time.

Using a VA Loan To Invest In Multifamily Property

The VA loan is not designed to help someone build up a portfolio of rental property. However, a savvy borrower can still use the VA loan program to build a portfolio of rental property if they know how to work within the rules. Remember, each property must be intended as a primary residence and you only get a 1 time VA loan restoration. After using the 1 time restoration you will need to sell any property that you purchased with VA, regardless of whether it has been refinanced out of the original VA loan, before you can buy again using a VA loan. If someone has used their one time restoration and has also tapped out their entitlement they could look into selling the properties that they purchased with VA originally and doing a 1031 exchange into a new investment property. By selling the properties a borrower would restore their ability to use a VA loan again. If they decide to do a 1031 exchange, the exchange would allow them to roll their equity into new investment property without having to pay any capital gains tax.

There are investors who have used their VA loan 10+ times using this strategy and have built significant rental property portfolios. In order to do this you have to be OK moving frequently because every VA loan is intended for a primary residence and can be converted into an investment property later. Using VA mortgages to purchase multi unit property is not only a great way to reduce your monthly mortgage payments but a great way to build generational wealth for your family and achieve financial independence.

Getting Started and Scaling Your Real Estate Portfolio your VA Loan

If you have questions about utilizing VA home loans we would honored to work with you. My team and I have lots of experience helping Veterans build and create wealth through the acquisition of real estate and we would be honored to share our resources and help you create and execute on a real estate investment plan. Our brokerage specializes in investment property sales/ multi unit property sales in Southern CA, specifically LA and Orange County and we love helping people utilize the VA mortgage benefits.