Introduction:

If you’re a real estate investor looking to sell your investment property and purchase a new one, it’s worth considering a 1031 exchange. This exchange is governed by Section 1031 of the US Internal Revenue Code and allows for the deferral of capital gains tax.

Essentially, it enables investors to reposition investment real estate to help meet their objectives while preserving all of their equity so it continues to work for them.

What is a 1031 Exchange?

A 1031 exchange is a type of tax-deferred exchange that enables real estate investors to postpone the payment of capital gains tax by selling their investment property and reinvesting the proceeds in another property or properties of like-kind and equal or greater value.

Investors must adhere to specific rules outlined in section 1031 of the IRS code. We will discuss the specific rules in detail later in this blog.

Reasons to Utilize a 1031 Exchange

There are several reasons why real estate investors may consider utilizing a 1031 exchange:

- Tax Benefits: As previously mentioned, the main benefit of a 1031 exchange is the capital gains tax deferral, which allows investors to keep more of their capital working for them rather than paying out a significant portion of their equity in taxes.

- Ability to Diversify: Investors may wish to diversify their real estate holdings and seek out properties with better return prospects or properties with other benefits. For example, a multifamily investors who is tired of property management may choose to do a 1031 exchange into a triple net property with less of a management burden while maintaining cash flow.

- Consolidate Properties: Investors may want to consolidate several properties into one, for estate planning purposes or to streamline their real estate holdings.

- Reset Depreciation: Investors can reset the depreciation clock by using a 1031 exchange, which allows them to take advantage of tax deductions on the new property.

- Increase Return on Equity: As equity in a property grows an investor’s return on equity may actually decrease. This happens because more and more dollars are built up in one property and they aren’t working as hard as they could be. To solve this, many investors will 1031 exchange into larger properties where they can use more leverage and thereby increase their return on equity. Investors may also look at exchanging into properties where there is an opportunity to add value, which would also increase their return on equity.

Types of 1031 Exchanges

Originally, only “Simultaneous Exchanges” were permitted in 1031 exchanges where one investment property was traded for another on a one-to-one basis. However, in the 1980s, the IRS allowed for “Delayed Exchanges” after the landmark “Starker Case” in federal tax court. Unlike Simultaneous Exchanges, Delayed Exchanges offer more flexibility, as sellers can sell their investment property to any buyer and subsequently use the sale proceeds to buy like-kind replacement property within 180 days.

Today, Delayed Exchanges are the most common type of 1031 exchange. Other exchange formats include Reverse Exchanges, where the replacement property is acquired first; Improvement Exchanges, which involve making improvements to the replacement property; Simultaneous Exchanges, which are now less common; and Partial Exchanges, which involve exchanging a portion of the original property.

Delayed 1031 Exchange

A delayed exchange is the most common type of exchange. In a delayed exchange real estate investors may take advantage of the full exchange period to acquire a replacement property.

Steps for a delayed Exchange:

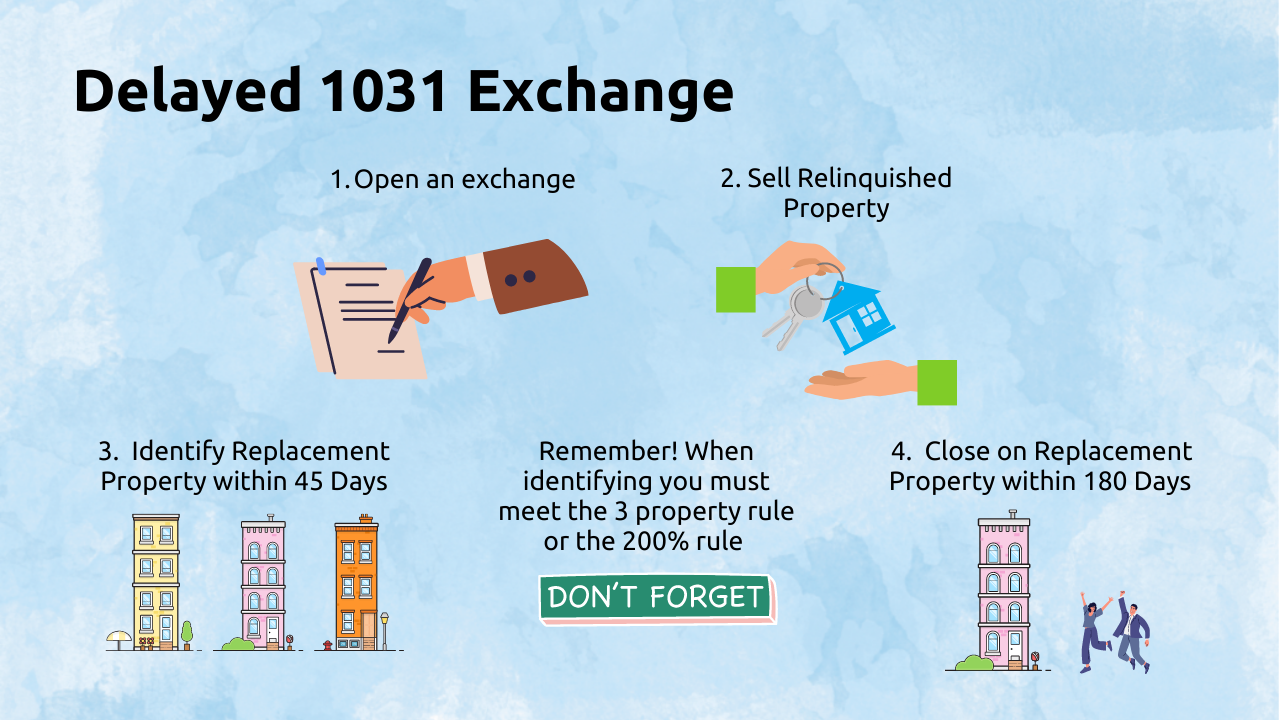

1. Open an Exchange

Real estate investors must open an exchange with a qualified intermediary prior to the close of escrow on the relinquished aka down-leg property.

2. Close Sale of Relinquished Property

Via an executed assignment, the 1031 Intermediary assumes the purchase contract and instructs the closing agent to deed the relinquished property directly from the investor to the buyer. The proceeds from the sale are sent directly to 1031 Intermediary, thus protecting the investor from the prohibited actual or constructive receipt of funds. The availability of these funds is restricted by the IRS.

3. Identification of Replacement Property – 45-day deadline

Real estate investors must identify the replacement property before midnight of the 45th day of the exchange. The clock for exchange deadlines (i.e. 45-day identification period and 180-day exchange period) starts the day after the close of escrow for the relinquished property. In order to be valid, the identification of the up-leg property must be in writing, signed by the investor and sent to a qualified party within the 45 days.

Rules for Identification of Replacement Property

The Three-Property Rule – Real estate investors may identify a maximum of three (3) replacement properties without regard to the total value of properties identified.

The 200% Rule – Real estate investors may choose to identify more than three (3) replacement properties. If an investor goes this route then total value of all properties identified must not exceed 200% of the relinquished property. If the 200% rule is exceeded, an investor can still make the 1031 exchange work by purchasing no less than 95% of the aggregate value of the properties identified. Failure to purchase 95% of the properties identified could result in capital gains taxes.

4. Close on Replacement Property

Within the 180-day exchange period, or before the investor’s tax filing date, the investor must close escrow on an identified replacement property. As with the down-leg property, the investor will assigns the purchase contract to the 1031 exchange intermediary. The exchange funds are then transferred from the intermediary to the escrow office handling the purchase of the replacement property.

Common 1031 Exchange Issues

Investment Property Only Tax

Deferred exchanges are available only for investment property. Primary residences do not qualify for exchanges. The universal exclusion (aka the primary residence exemption), under section 121 of the Internal Revenue Code, permits the elimination of capital gains from the sale of primary residences if certain conditions are met.

If a portion of a primary residence is used for investment purposes, that portion may be exchanged. For example an investor who owns a duplex and lives in one unit could sell their duplex, take the “universal exclusion” for the portion of the property that they occupy and 1031 exchange the portion of the property that is used for investment.

Cash and Debt Boot

Any cash proceeds remaining after the acquisition of replacement property are considered “cash boot” and are taxable at the capital gains tax rate. Access to these funds is limited in accordance with IRS restrictions. If debt is not replaced it is considered “mortgage boot,” which also incurs tax liability to the investor at the capital gains tax rate. As each investor’s financial situation varies, we highly recommended that investors consult their accountant before opening an exchange.

DSTs (Delaware Statutory Trusts)

DSTs enable investors to pool their assets with others in the purchase of like-kind replacement property, offering financial security and low maintenance for investors. However, individual investors must confirm that their corresponding interest is adequate to defer all capital gains tax associated with the sale of their relinquished property.

Partnerships

Partnerships are allowed to exchange, provided that the exchange takes place at the partnership level. Complex tax issues arise when underlying partners have varying investment goals and choose to separate or restructure. Seeking advice from a tax professional is crucial to ensure that the partnership receives the expected tax benefits.

Partial Exchange

The IRS allows for partial exchanges where an investor can use a portion of the net proceeds from selling their investment property to purchase a replacement property and exclude the remaining amount for personal use. However, any excluded funds are considered cash boot and will be subject to capital gains taxes, and potentially subject to withholding. To avoid delays, the investor must inform their 1031 intermediary before the close of escrow on the relinquished property of their intention to exclude cash. Otherwise, they may have to wait until the end of the exchange period to access the remaining funds. We advise investors to seek advice from their accountant or tax attorney to determine whether a partial exchange is advantageous for them.