Introduction

In Southern California real estate prices are high and it can be difficult for first time buyers to save up a down payment to purchase their first investment property. Buyers in this situation may want to consider using FHA financing.

FHA loans were created by the Federal Housing Administration in the 1930’s. During the great depression of the 1930’s the housing market was on thin ice. Defaults and Foreclosures had exploded and it was impossible for the average wager earner to save the 50% down payment that was commonly required. To help resolve this issue the federal government created FHA loans as a way to reduce risks to lenders and make it easier for borrowers to qualify for financing.

What is FHA Financing and Who Can Use It

FHA loans were originally designed to help low to middle income borrowers purchase a primary residence. Because these loans are backed by the federal government borrowers can put down as little as 3.5% and there is a lower bar for other qualifying factors like debt to income ratio and credit score. Some people think FHA is too good to be true and that may be the reason there are so many misconceptions with FHA financing.

Here are some of the most common misconceptions that we hear:

1) Do you have to be low or middle income in order to use FHA finance?

No! There are no income limits for borrowers who want to used FHA financing.

2) You must be a first time buyer to use FHA financing and you can’t own any other property.

This is false. You can use FHA financing even if you own other property. One important point to emphasize is that FHA is intended for the purchase of a primary residence so you must occupy the property for at least 1 year as a primary residence.

3) You can only use FHA financing once.

This is also false! You can only have one active FHA loan at a time but there is no limit on the number of times you can use FHA financing. For example, a borrower could buy a property with FHA financing and once they have enough equity in the property they could refinance into a conventional loan and then use FHA financing to purchase another property.

It’s important to take note of owner occupancy requirements. If you refinance the property from an FHA loan into a conventional loan that is intended for owner occupants then you may not be able to used your FHA loan until you have met the owner occupancy requirement for the conventional loan. After all you can’t have two primary residences at the same time. If you plan to do this you should consider refinancing from an FHA loan into an investment loan that doesn’t have an owner occupancy requirement.

4) You can only use FHA financing on condos, townhomes, and single family residences.

Wrong! You can use FHA financing on on residential properties between 1 and 4 units. If you purchase a multifamily property with FHA financing you must still occupy one of the units. There are some other factors that come into play which we will discuss in the following sections.

Using FHA to Purchase Multifamily Property

When using FHA financing to purchase a multifamily property most of the same loan guidelines apply (down payment, DTI, Credit score, etc.) but there are some key benefits and drawbacks.

One benefit of using FHA financing to purchase multifamily property is that you can count some of the rental income from the units that you don’t plan to occupy to help you qualify for the loan. This means that FHA buyers will qualify for larger loans on 2,3, and 4 unit properties than they will on a single family. The FHA loan limits also increase based on the number of units a property has which helps borrowers stay within the conforming loan limits and get the best rates and terms on their loan.

One of the drawbacks of using FHA financing on 3 and 4 unit properties is that there is an additional qualifying factor that the property must meet. This factor is called the self sufficiency test. In order to pass the self sufficiency test 75% of the “market rents” must be equal to or greater than the monthly payment of Principle, Interest, Taxes, Insurance, and Mortgage Insurance. The appraiser is the one who determines what the market rents which sometimes makes it difficult to determine if a property will pass the self sufficiency test before opening escrow. Below is an example of how to calculate the self sufficiency test

In this example we are examining a 4-unit property that has upside in rents. If an appraiser agrees that the market rent for all 4-units is $2,550, then this property will pass the FHA self sufficiency test. Our total market rent would be $10,200. If we multiply our market rent by 75% we get $7,650 which is greater than our monthly PITI & MI (principle, interest, taxes, insurance, and Mortgage Insurance) of $7,626.

Other Restrictions On FHA Financing

Properties financed with FHA loans must meet safety, security, and soundness standards, which include areas like roofs, electrical, water heaters, and property access, among others.

Some common issues that may need to be resolved before an FHA loan can be funded include health and safety issues like: missing handrails, chipping lead paint, exposed asbestos, broken windows, broken tiles, etc.

Owner Occupancy Requirement

FHA loan guidelines require a borrower to occupy the property that they are buying as their primary residence for at least 1 year. By FHA standards, a primary residence is one in which the owner occupies the property for the majority of the year. The FHA also requires that the buyer moves into the property within 60 days of closing on the property.

These requirements are intended to prevent investors from profiting off the government loan program’s affordable rates and less stringent lending guidelines. Violating the FHA’s occupancy requirements could qualify as fraud and lead to a civil or criminal lawsuit against the borrower.

After occupying an FHA-backed property for at least the first year, owners are free to use the property as they wish. This can include renting the property out or using it as a secondary or vacation home.

Mortgage Insurance: UFMIP & MIP

There are two types of mortgage insurance that borrowers will encounter with FHA loans: Up Front Mortgage Insurance Premium (UFMIP) & the monthly Mortgage Insurance Premium (MIP). Because the borrower is putting less money down and the borrower has less of their own money invested there is a higher likelihood of default with FHA loans. The UFMIP and MIP are designed to help mitigate this risk and protect the lender.

Up-Front Mortgage Insurance Premium- (UFMIP)

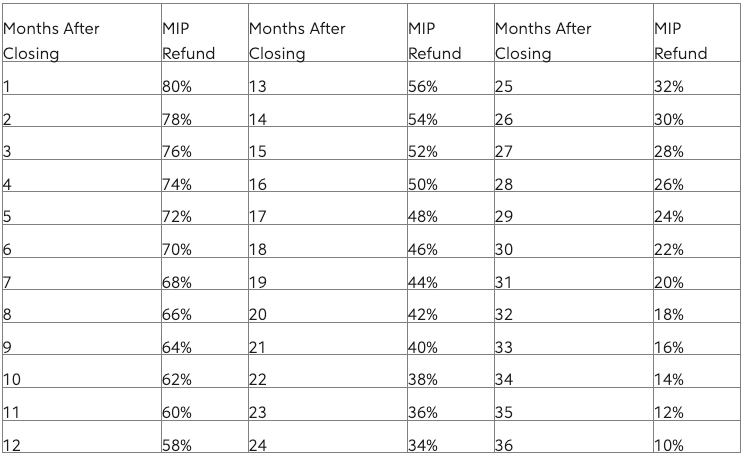

The Up-Front Mortgage Insurance Premium (UFMIP) is paid at closing and borrowers can either pay the UFMIP in cash or the cost can be financed into the loan amount. The cost of the UFMIP as of 2023 is 1.75% of the loan amount. If you refinance or sell the property within 3 years you are eligible for a partial refund of the UFMIP as outlined in the chart below.

Mortgage Insurance Premium- (MIP)

There is a monthly MIP that FHA borrowers must pay for the life of the loan. The cost of the MIP will depend on whether the loan amount is within the conforming loan limits. If the loan amount is over the conforming loan limit it will be considered a “High Balance” and the MIP cost will increase slightly. For conforming loans the MIP is an annual cost of .55% of the loan amount.

Before 2013 MIP used to go away after a borrower reached 20% equity in a property, however now the MIP must be paid for the life of the loan in most cases. Because of this change, most borrowers will explore refinancing into a conventional owner-occupied loan once they reach 20% equity or a conventional investment loan once they reach 25% equity.

First Steps Towards Buying a Property With FHA Financing

The first steps are to connect with a loan broker and a real estate broker/agent. The loan broker will be able to if you qualify for an FHA loan based on your current financial situation. A real estate broker will be able to show you what multifamily properties you may be able to purchase with your FHA loan. We have helped tons of first time and experienced investors use FHA financing to purchase multifamily property and we have great relationships with lenders who have helped our clients with these types of loans. If you are interested in learning more, reach out to us today!